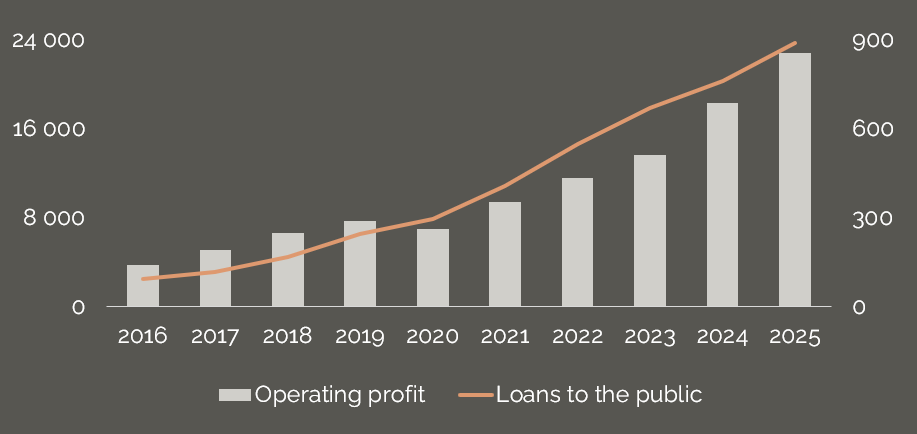

TF Bank’s strategy is based on driving profitable growth through a diversified geographical presence in selected European markets. To meet the increasing demand and maximise customer value, the Bank is continuously working to improve efficiency and strengthen its competitiveness, while accelerating the development of Credit Cards and Ecommerce Solutions. Compound annual growth rate in the loan portfolio 2016-2025 Compound annual growth rate in the operating profit 2016-2025 Geographical markets as of 31 December 2025 Share of loan portfolio compiled of the segments Credit Cards and Ecommerce Solutions as of 31 December 2025

Growth with profitability in focus

TF Bank was founded in 1987 in Borås and has since managed to combine rapid growth with strong profitability, which is a central part of the Company’s long-term strategy. By expanding its geographical presence, the Bank has been able to ensure robust growth without compromising profitability.

A key factor behind its success is the Bank’s ability to quickly put decisions into practice, without burdening the business with high costs or long waiting times. By maintaining high profitability, the Bank can continue to reinvest in the business and provide its shareholders with an attractive risk-adjusted return.

European bank with a diversified portfolio

TF Bank is a pan-European provider of financial services to private individuals, providing investors with a unique opportunity to gain exposure to 14 European countries. Geographical diversification is a key component of the Bank’s strategy, both in lending and deposits. By offering services in different markets, TF Bank can create new growth opportunities, spread the risk and ensure lower financing costs.

The Bank’s expansion takes place in carefully selected segments and markets. With short decision-making paths, TF Bank has the opportunity to quickly adapt and effectively influence where capital should be allocated. When TF Bank establishes itself in a new market, a low and grow strategy is applied where the Bank initially takes a relatively low risk to get to know the market. As knowledge of the market increases, more capital can be allocated to grow to a greater extent. Growth in the number of active cards during 2025 Growth in the transaction volume for Ecommerce Solutions during 2025

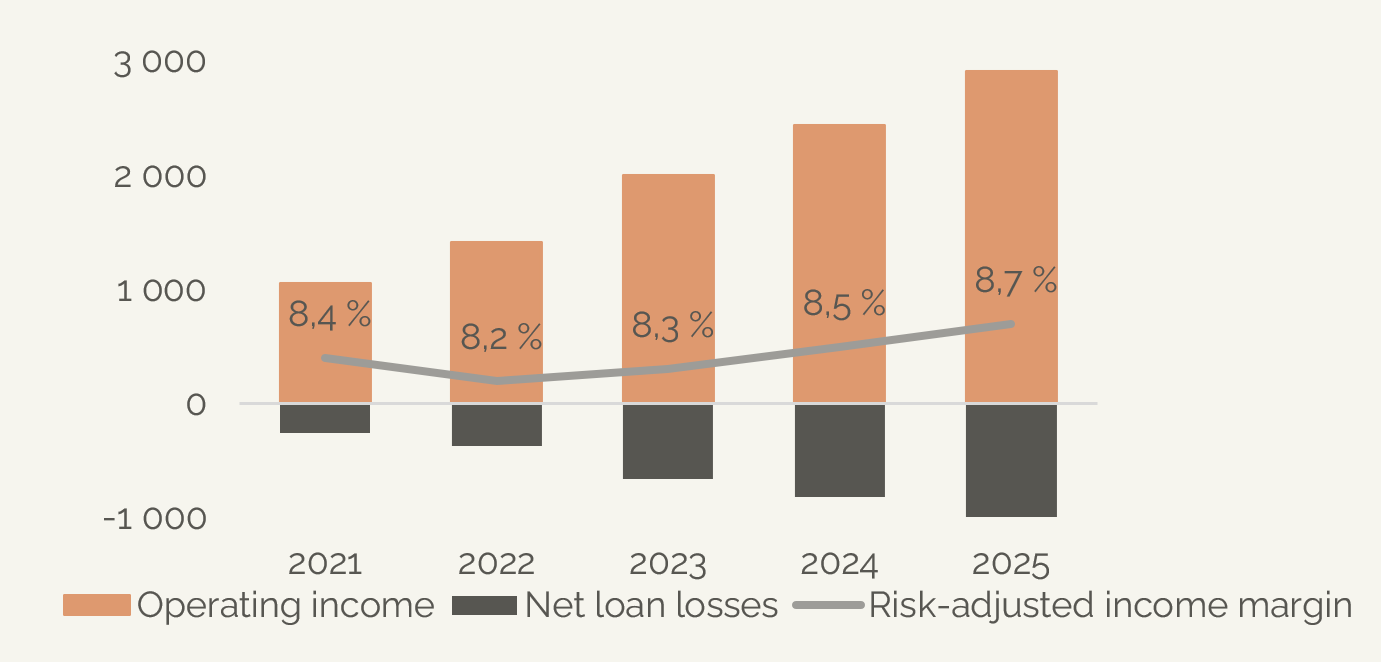

Strong risk-adjusted income margin

Responsible lending has always been fundamental to TF Bank’s business strategy. By continuously improving its credit assessment processes and avoiding unnecessary risk-taking, the Bank ensures controlled loan loss levels and contributes to a stable economy.

The Bank has no ambition to become the market leader in any country, or in any product area. Instead, TF Bank strives to identify the customer segment where it is currently possible to find a good risk-adjusted income margin.

Growth opportunities in Credit Cards and Ecommerce Solutions

A majority of TF Bank’s combined operations are now conducted in the Credit Cards and Ecommerce Solutions segments, where the business flow is managed jointly across several countries. The growing credit card balance represents a significant driver of the Bank’s organic growth.

The strong position in the Nordic market in the Ecommerce Solutions segment, in combination with the expansion into Germany in 2025, has further strengthened TF Bank’s offering. For our Nordic partners, this means both a valuable addition to the offering and an easier path for profitable expansion into new markets.